Finding the right accounting automation software was the biggest challenge I faced during my early career. I worked with a small construction company that was still using spreadsheets to manage their finances. As the company grew, they found it difficult to manage accounting, leading to errors and wasted time. In search of better software, I researched various options and decided to implement a cloud-based solution. This move helped in invoicing, expense tracking, and reconciliation, saving hours of manual work. The results were immediate—fewer mistakes, real-time financial insights, and better decision-making.

Later, I helped another small business facing similar issues with their outdated software. They were struggling with inventory tracking and reporting. After selecting and setting up an automated accounting system, they saw a significant improvement in efficiency and accuracy, allowing them to focus more on growing their business. This experience reinforced how crucial the right accounting software can be a game changer, especially when scaling a business.

In 2025, accounting automation software are more essential than ever for businesses. It has improved efficiency, reduced manual work, and ensured accurate financial management. With the growing demand for streamlined financial processes, these tools can handle tasks ranging from invoicing and tax calculations to payroll and financial reporting. In this blog, we explore the best 10 accounting automation tools that are reshaping the financial landscape for businesses of all sizes.

What is Accounting Automation Software?

Accounting automation software automates accounting processes so that the most time-consuming and inefficient tasks can be completed instantly. These processes may include filing taxes, financial reporting, invoicing, payroll management, and bank reconciliation. The automation of these tasks saves businesses time, reduces errors, and ensures compliance with financial regulations.

For instance, the cloud-based accounting program Xero helps firms save time and cut down on errors by automating financial reporting, tax filing, and invoicing.

Why Do We Need Accounting Automation Software?

- Increased Efficiency: Automation reduces the time spent on manual data entry and repetitive tasks.

- Error Reduction: With fewer manual interventions, it reduces the human error in financial records.

- Cost Savings: By automating accounting processes, businesses can reduce the extensive administrative staff.

- Scalability: These tools can handle an increasing volume of transactions without needing to scale human resources.t

- Compliance: Accounting automation ensures that businesses stay compliant with the latest financial regulations and tax laws.

- Real-Time Financial Insights: Automation tools provide instant access to financial data, allowing for better decision-making.

Best Accounting Automation Software for Businesses

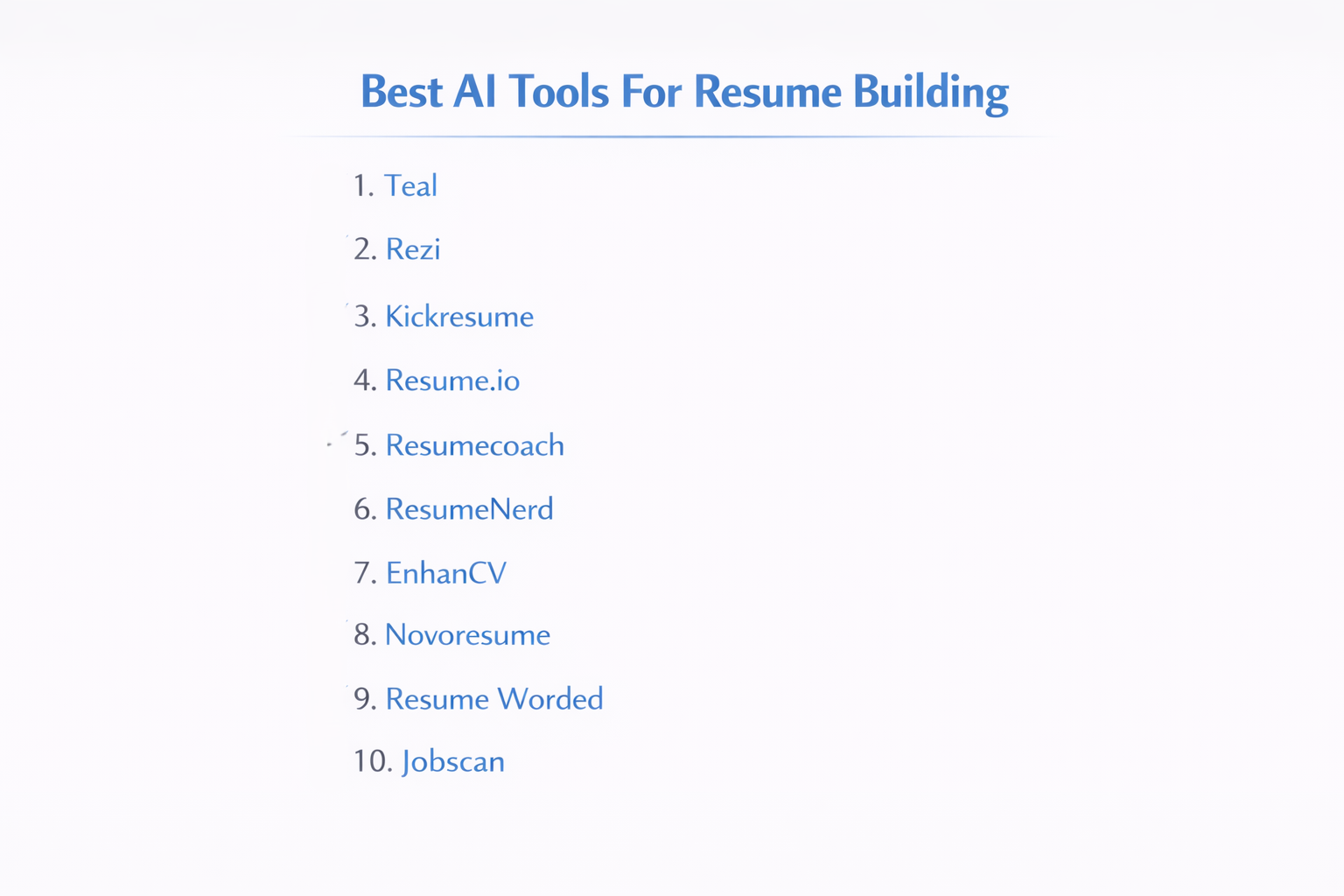

1. Tally Prime

Tally Prime is a comprehensive accounting software that offers robust features for managing finances, inventory, and compliance.

Key Features

- Billing & Invoicing

- Inventory Management

- GST Compliance

- Bank Reconciliation

- Financial Reporting

Best For

- Businesses need scalable accounting solutions with strong inventory management.

Pros

- Highly Customizable: Offers flexibility, allowing businesses to tailor the system to their specific needs.

- Strong Inventory Management: Ideal for companies that need detailed stock tracking and management features.

- User-Friendly Interface: With basic accounting knowledge it’s easy to navigate for users.

Cons

- Limited Cloud Features: While Tally Prime offers cloud support through Tally on Cloud, it’s primarily a desktop solution.

- Complex for Simpler Needs: Businesses with straightforward accounting needs may find Tally Prime’s advanced features overwhelming and difficult.

- Pricing for Smaller Businesses: As businesses grow, Tally Prime can become expensive for small enterprises.

2. Zoho Books

Zoho Books is a cloud-based accounting software designed to help businesses manage invoicing, expenses, and compliance efficiently.

Key Features

- Invoicing & Estimates

- Expense Tracking

- Bank Reconciliation

- Project & Time Tracking

- GST Compliance

Best For

- Businesses looking for an affordable, user-friendly solution with strong tax compliance features.

Pros

- Affordable: Zoho Books offers a budget-friendly option with transparent pricing.

- Seamless Integration: Works well with other Zoho applications, offering a complete suite for business management.

- Customizable Workflows: Allows businesses to create automated workflows to streamline accounting processes.

Cons

- Limited Inventory Management: Not the best choice for businesses dealing with large inventories.

- Third-Party Integrations: Fewer integrations compared to larger solutions like Xero.

- Learning Curve: Users unfamiliar with accounting software may face a learning curve in navigating its features.

3. FreshBooks

FreshBooks is a cloud-based accounting tool tailored for freelancers, small businesses, and service-based companies.

Key Features

- Comprehensive Invoicing

- Expense Tracking

- Time Tracking

- Payment Processing

- Project Management

Best For

- Freelancers, consultants, and small agencies that need a simple yet effective accounting solution.

Pros

- User-Friendly Interface: FreshBooks is very easy to use, making it ideal for people without accounting backgrounds.

- Automated Features: Saving users time on administrative tasks like invoicing, time tracking, and payments.

- Mobile-Friendly: Accessible on mobile devices, helps the users to manage finances from anywhere.

Cons

- Lack of Advanced Inventory Management: This software is not suitable for businesses with extensive product-based operations.

- Pricing Increases: As you add more clients or team members, the cost of FreshBooks increases.

- Limited Reporting: Compared to larger software like Xero , FreshBooks has limited financial reporting features.

4. Xero

Xero is a powerful, cloud-based accounting tool that’s designed to handle the financial needs of businesses of all sizes.

Key Features

- Multi-Currency Support

- Bank Reconciliation

- Financial Reporting

- Expense & Invoice Tracking

- Third-Party Integrations

Best For

- Businesses that need multi-currency support or require extensive integrations with third-party apps.

Pros

- Multi-Currency Support: Xero is excellent for businesses with international clients and transactions.

- Real-Time Tracking: With automatic bank feeds and reconciliation, users have real-time access to their financial data.

- Extensive Integrations: Xero supports over 1,000 third-party integrations, including apps for payroll, CRM, and e-commerce.

Cons

- No Built-In Inventory Management: Businesses that require robust inventory management may need to use third-party integrations.

- Pricing: Xero’s subscription fees can be more expensive than alternatives like FreshBooks.

- Customer Support: Response times can be slow, especially during peak hours.

5. Busy Software

Busy Software is an accounting and business management solution designed to help businesses with accounting, inventory management, and compliance.

Key Features

- Invoicing & Billing

- Inventory Management

- GST Compliance

- Financial Reporting

- Multi-User Access

Best For

- Retailers, manufacturers, and wholesalers that require integrated accounting and inventory solutions.

Pros

- Simple Interface: Busy Software is easy to use and navigate, making it accessible for both accountants and non-accountants.

- Excellent Inventory Management: It offers strong inventory management, ideal for businesses with significant stock to track.

- Customizable Features: Users can tailor the software to suit their specific business needs.

Cons

- Limited Cloud Features: Primarily a desktop solution, which may limit its appeal for businesses looking for cloud-based solutions.

- Lack of Payroll Features: Busy Software doesn’t have advanced payroll features, making it unsuitable for businesses with complex HR needs.

- Learning Curve: New users may find the software complex, especially when dealing with customization options.

6. Wave Accounting

Wave Accounting is a free accounting tool ideal for freelancers and small businesses that need basic accounting features.

Key Features

- Free Invoicing & Billing

- Expense Tracking

- Financial Reporting

- Receipt Scanning

Best For

- Freelancers and small businesses with simple accounting needs.

Pros

- Completely Free: Wave offers a robust suite of features for free, making it an excellent option for startups.

- Simple and Easy to Use: The user interface is straightforward, making it perfect for non-accountants.

- Basic Features: Covers basic accounting needs like invoicing, expense tracking, and financial reporting.

Cons

- Limited Advanced Features: Wave lacks advanced features like inventory management and payroll processing.

- Limited Customer Support: As a free tool, Wave offers limited support options.

- Fewer Integrations: Compared to paid software, Wave has fewer integrations with third-party applications.

7. Kashoo

Kashoo is a cloud-based accounting tool that offers a straightforward solution for small businesses.

Key Features

- Automated Invoicing

- Expense Tracking

- Financial Reporting

Best For

- Small businesses that need basic accounting automation.

Pros

- Affordable: Kashoo is budget-friendly, ideal for small businesses.

- Easy to Use: With its simple interface, Kashoo is perfect for non-accountants.

- Automatic Income and Expense Tracking: Kashoo automatically categorizes transactions, saving time on bookkeeping.

Cons

- Limited Features: Lacks advanced features like inventory management, payroll, and advanced reporting.

- Limited Integrations: Kashoo doesn’t integrate with as many third-party tools as competitors.

- Basic Reporting: The reporting features are basic compared to more sophisticated tools like Xero.

8. Sage Intacct

Sage Intacct is a cloud-based financial management system designed for mid-sized and large businesses.

Key Features

- Multi-Currency Support

- Advanced Financial Reporting

- Automation for Accounting Tasks

- Cloud-Based Financial Management

Best For

- Mid-sized businesses with complex accounting needs.

Pros

- Highly Customizable: Sage Intacct is ideal for businesses with complex reporting and financial management needs.

- Real-Time Access: Being cloud-based, it allows for real-time access to financial data from anywhere.

- Advanced Reporting: Offers in-depth financial reports, helping businesses gain valuable insights into their operations.

Cons

- Expensive: Sage Intacct is a premium solution with a high price point, making it unaffordable for small businesses.

- Complex Setup: Businesses may require a professional implementation team to set up Sage Intacct properly.

- Learning Curve: The software can be difficult for new users to navigate due to its complexity.

9. Microsoft Dynamics GP

Microsoft Dynamics GP is a comprehensive ERP solution with strong accounting automation features.

Key Features

- Financial Management

- Payroll Automation

- Reporting & Analytics

- Multi-Currency Support

Best For

- Large enterprises that require a complete ERP solution for accounting and other business functions.

Pros

- Comprehensive Features: Dynamics GP covers all aspects of business management, including accounting, payroll, and reporting.

- Microsoft Integration: Seamlessly integrates with other Microsoft products like Excel and Power BI.

- Customizable: Highly customizable to meet the specific needs of large enterprises.

Cons

- Expensive: Dynamics GP is one of the most expensive solutions available.

- Complex Implementation: Requires professional implementation and extensive setup time.

- Not Ideal for Small Businesses: Due to its cost and complexity, it’s more suited to larger organizations.

10. Sage 50cloud

Sage 50cloud offers powerful accounting automation features for small to medium-sized businesses, combining desktop software with cloud functionality.

Key Features

- Invoicing & Billing

- Expense Tracking

- Payroll Management

- Financial Reporting

Best For

- Small to mid-sized businesses looking for desktop software with cloud capabilities.

Pros

- Comprehensive Accounting Features: Covers all key areas of accounting, including payroll, invoicing, and financial reporting.

- Cloud Access: Integrates cloud features, allowing access from anywhere.

- Strong Customer Support: Sage offers excellent customer service and support for users.

Cons

- Complex Setup: Initial setup can be challenging for new users.

- Expensive: Sage 50cloud’s pricing is on the higher side, making it less ideal for businesses with simpler accounting needs.

- Limited Customization: Fewer customization options compared to more flexible software like Xero.

Accounting Tasks You Can Automate

Automating accounting tasks helps businesses focus on strategic financial management ,save time, and reduce errors. Here are some accounting tasks you can automate:

- Invoices & Billing

Use FreshBooks to automatically generate invoices, send reminders , and accept online payments. - Payroll Processing

To calculate wages, tax deductions , and employee benefits, use automated tools. - Monitoring Expenses

To track and classify expenses in real-time by linking your accounts use tools like Wave. - Calculations and Tax filing

Automate tax calculations and filings with software like Tipalti, ensuring compliance. - Financial Reporting and Reconciliation

Automatically reconcile bank transactions and generate reports using tools like Xero.

Automating these tasks streamlines accounting operations, saves time, and reduces human error.

How to Automate the Accounting Process

1. Use Cloud-Based Solutions: Cloud-based tools allow for real-time access and automated updates, ensuring that all financial data is current and accurate.

2. Automate Invoicing: Set up recurring invoices and automatic payment reminders to streamline cash flow management.

3. Integrate Payroll Automation: Automate payroll calculations and tax filings to ensure accuracy and compliance.

4. Set Up Automatic Bank Reconciliation: Link your accounting software to your bank accounts for automatic reconciliation and error-free financial records.

5. Automate Financial Reporting: Schedule automated reports to generate monthly, quarterly, and annual financial summaries for review.

Conclusion

The rise of accounting automation tools has simplified financial management for businesses, allowing them to focus more on growth and strategic decisions. From small businesses using Wave Accounting to larger enterprises leveraging Sage Intacct or Microsoft Dynamics GP, there are a variety of options available to suit every need. By selecting the right tool, businesses can save time, reduce errors, and ensure compliance with ease.

FAQs

1. Can accounting automation software help with tax filing?

Yes, many accounting automation tools, such as Sage Intacct and Xero, have built-in tax filing features to help ensure compliance.

2. Are these tools secure?

Yes, most accounting automation software providers implement high-level encryption and security measures to protect your financial data.

3. Do these tools support payroll automation?

Yes, tools like Sage 50cloud and Microsoft Dynamics GP offer payroll automation as part of their features.

4. Are these tools suitable for international businesses?

Yes, many of these tools, including Xero and Sage Intacct, offer multi-currency support, making them ideal for businesses with international clients.

5. How much do accounting automation tools cost?

Costs vary depending on the software, with some offering free versions (like Wave Accounting) and others offering premium pricing for more advanced features.

2 comments